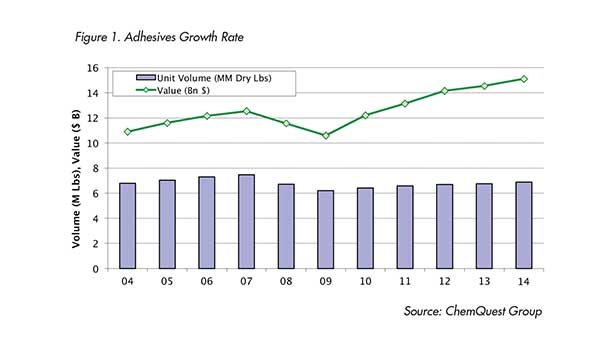

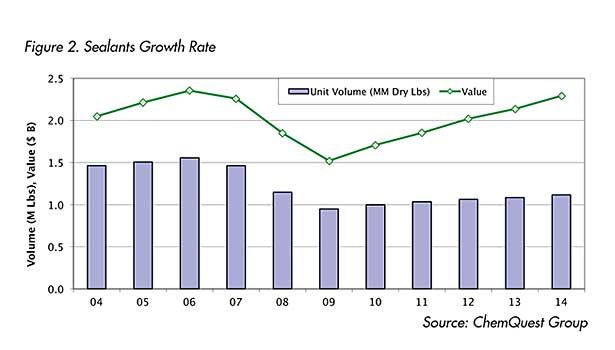

The outlook for the U.S. adhesives and sealants industry at the mid-point of 2014 has slightly improved over 2013 (see Figures 1 and 2). After growing just 1.9% in 2013, most economists are predicting the U.S. gross domestic product (GDP) will grow 3% for 2014. Recent economic data has been showing uneven but improving growth after contracting 1% (annualized rate) in the first quarter due to weather.

For 2013, ChemQuest estimates that the U.S. adhesive industry grew < 1% in volume terms and 2.7% in terms of value. Sealants did better, growing about 2% in volume and nearly 6% in value in 2013. The primary reason for sealants outpacing adhesives was the strength in the transportation and construction industries, where they find greater use. In 2014, ChemQuest estimates adhesives and sealants to grow 2-3% in volume and twice that in terms of value.

Profitability Trends

The cost structure for adhesive and sealant firms has been relatively steady over the last few years, with raw materials accounting for 52-63% of the cost of goods sold. That compares to 45-53% typically seen in the coatings industry; the difference is that adhesives use higher molecular weight products that have higher crude input than coatings. Over the last 10 years, adhesive and sealant producers have seen a slight increase in gross margin, and a larger one in terms of profit margin as they have been successful at lowering overhead expenses.

Construction Sector Outlook

Overall construction spending continues to recover and stands at 77% of its all-time high, reached in 2007. Total construction spending in 2013 was $900 billion, an increase of 5% over 2012. Private construction rose 8.8% in 2013 and is on track to rise 9% in 2014, led by residential. Public construction has been falling since 2009 and declined 2.7% in 2013.

Residential housing continues to gradually improve, but was weak in the first quarter of 2014, probably due to poor weather. New housing construction has historically represented about 5% of overall GDP, but it is currently only about 3%. Seasonally adjusted housing starts (single- and multi-family) were greater than 1 million in April; however, the growth in multi-family starts continues to be stronger than that of single family starts. The inventory of new homes has been building over the last six months as builders have become more confident.

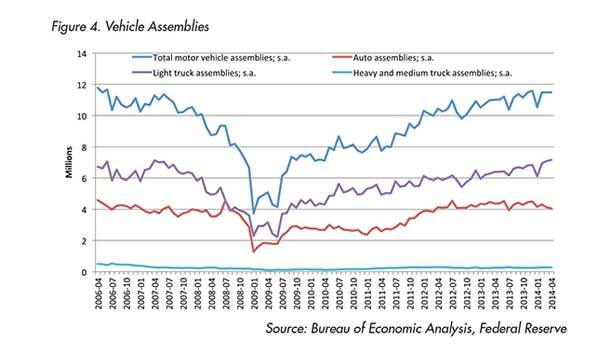

Motor Vehicles

The motor vehicle industry continues to be a positive force for the adhesives and sealants industry in 2014. Auto and light truck sales were 15.6 million units in 2013 and are on track to exceed 16 million units in 2014.

Overall Industrial Production

Overall durable-goods manufacturing increased 12.6% in 2013 after increasing 10% in 2012 and 6.1% in 2011. This sector has been the largest contributor to GDP the last three years. Industrial production is a key driver for adhesive and sealant OEM applications for component assemblies.

An Optimistic Outlook

U.S. adhesive and sealant manufacturers have benefited from a U.S. economy that has been growing quicker than other developed economic regions, specifically Europe. The industry’s balance sheet continues to improve. Companies are becoming less reluctant to spend on capital improvements and pursue mergers and acquisition opportunities.

For many years, adhesive and sealant companies have improved their profitability mainly through improved operational efficiency. Growing revenue—and volume in particular—remained an elusive proposition in an era of slow growth, but one that the industry finally appears on track to achieve.