The ChemQuest Group currently estimates the value of the global adhesives and sealants industry at approximately $51 billion, comprised of $44.5 million in adhesives and $6.2 billion in sealants. Regionally speaking, North America, Europe and Asia each make up 31% of the total, with the remainder split between South America and the Middle East/Africa (see Figure 1).

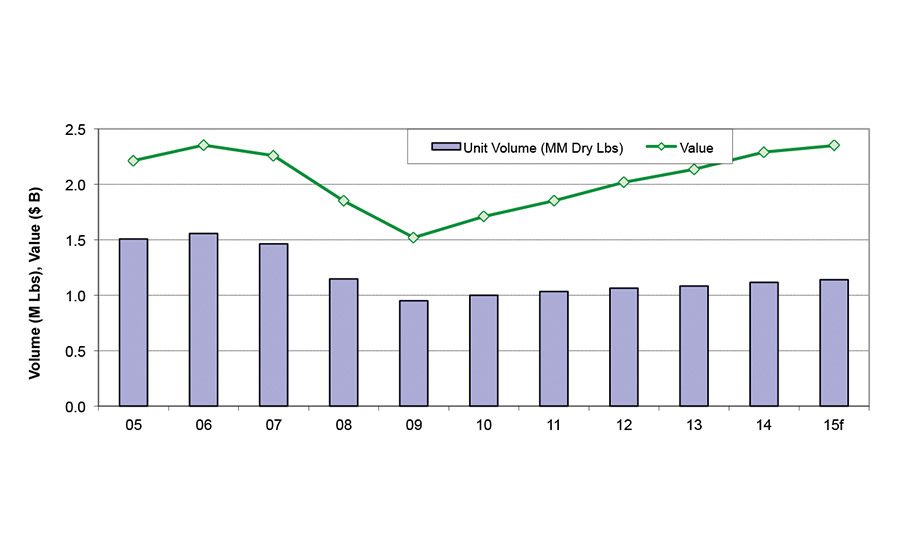

In North America, adhesives comprise a larger percentage of the market than sealants. Sealants make up approximately 1.1 billion lbs (see Figure 2), compared to 7 billion lbs of adhesives (see Figure 3). The adhesives industry’s value is nearly $16 billion, compared to $2.4 billion for sealants. Despite the slow first half of this year, we expect the adhesives and sealants industry to grow about 1.5-2.5% in volume and an additional half-percent in pricing, and overall growth of 2-3% in terms of value.

Among the North American market segments, packaging was relatively flat in 2014; transportation was markedly up, construction and consumer were relatively flat, and product assembly was somewhat flat (see Figure 4). Two sectors that grew were transportation and tapes. We expect the packaging and consumer sectors to increase this year, due to improving consumer spending. In addition, with rising manufacturing activity, we expect product assembly to grow. Thus, as of now, we expect to see five or all six of these sectors rising this year.

In terms of the macro demand drivers for adhesives and sealants, the industry faces generally positive fundamentals across the end-use markets. Construction, the largest end-use category, continues to see improvements in both public and private construction spending; stricter building standards for construction activity are helping as well. The drive for increased fuel efficiency demand in transportation is spurring manufacturers to use more composites and plastics in order to save weight, which also creates a need for more non-mechanical adhesive bonding materials. In the packaging sector, the use of flexible packaging is continuing to decrease demand for rigid packaging, such as metal and glass containers.

Finally, the input cost structure for formulators in the adhesives and sealants industry continues to be favorable. Raw material inputs, in particular, have decreased for domestic producers, as oil and other commodities have declined due to lower oil prices over the past year.

Any views or opinions expressed in this column are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.