Our industry has seen an unprecedented increase in moisture-related claims due to many factors associated with a wider selection of floor coverings in use. These factors range from fast-track building construction and the increased use of non-standard size flooring tiles and planks to a reduction in porous floor-covering backings, as well as improperly specified and applied adhesives, improperly trained installers and poor drainage. Innovation and education can drive application-specific solutions to reduce moisture damage. Standard laboratory test methods for adhesives that better align with temperature, humidity and alkalinity in the field may increase the likelihood that adhesives will perform as specified regardless of geographic location and environmental conditions.

Each value chain participant has a complementary role in profitably delivering superior adhesive performance. Moreover, developing the “right” adhesive formula at the point of sale for flooring would mitigate costly failure claims and subsequent damage to adhesives’ brands caused by bad publicity.

Historically, adhesive formulators have formed industry alliances, albeit somewhat limited in scope. Stronger partnerships in the adhesives value chain are necessary for greater customer satisfaction. In particular, strengthening ties between formulators and their raw material suppliers can be mutually beneficial.

Of course, there are barriers to such partnerships. For example, a chemical supplier may not wish to invest its R&D resources into developing a new polymer for a vertically integrated formulator. Conversely, an adhesives formulator may be unwilling to share proprietary information with its suppliers for competitive reasons. However, I’ve seen how those barriers can be overcome through creativity and discipline.

Rising Demand

Formulators know the market and its applications; they work effectively with the installation community and floor covering associations, but not all formulators have the resources or technical/R&D knowhow. While chemical suppliers bring unparalleled chemistry talent to their customers, they lack insights gained in the field while installing carpeting, ceramic, resilient and wood flooring. One adhesive company’s pithy advertising says it all: “Doesn’t it make sense to use a better adhesive?” Indeed, doesn’t it make good business sense to develop the right adhesive the first time around? Notwithstanding the eventual demise of the cottage industry that sprang up to investigate and resolve claims, the overall flooring market would demonstrably profit from better-performing adhesives. While many formulators continue to make significant investments in improving their product offerings through in-house development initiatives, innovation is noticeably the missing ingredient.

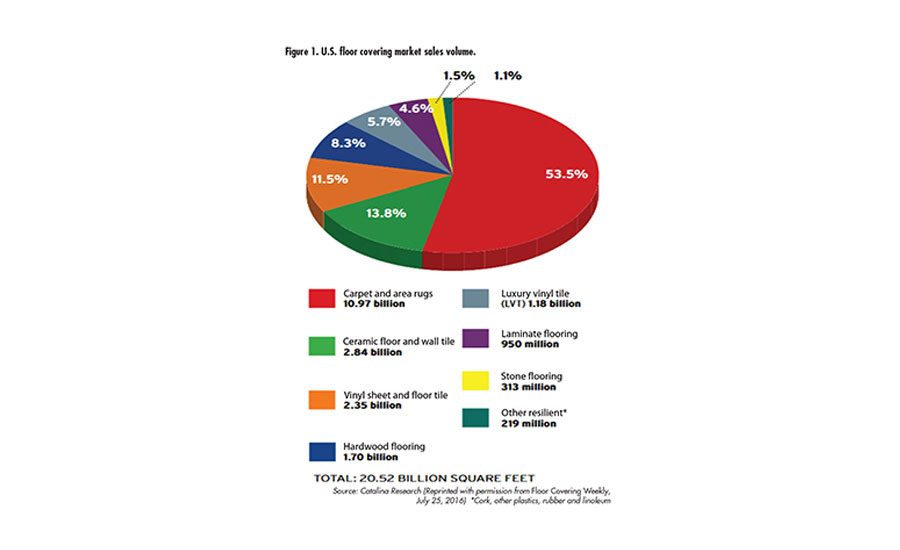

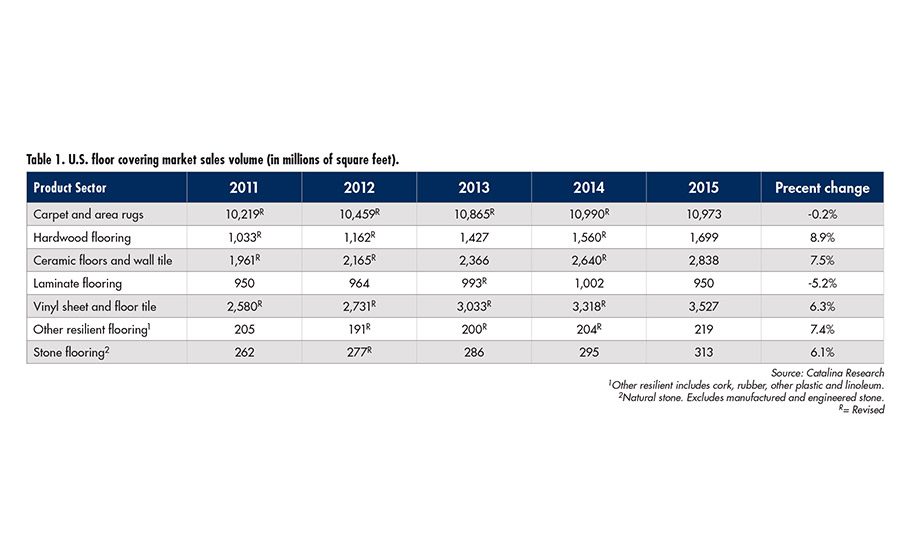

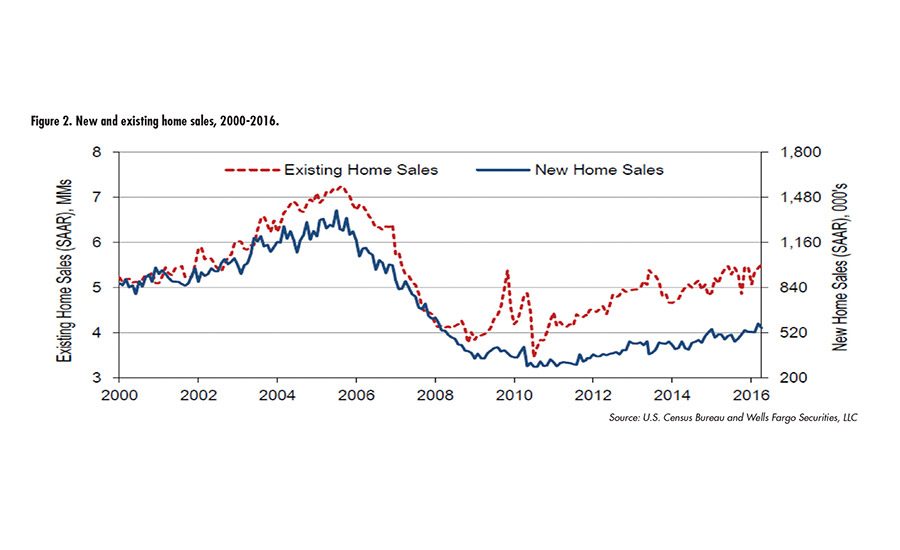

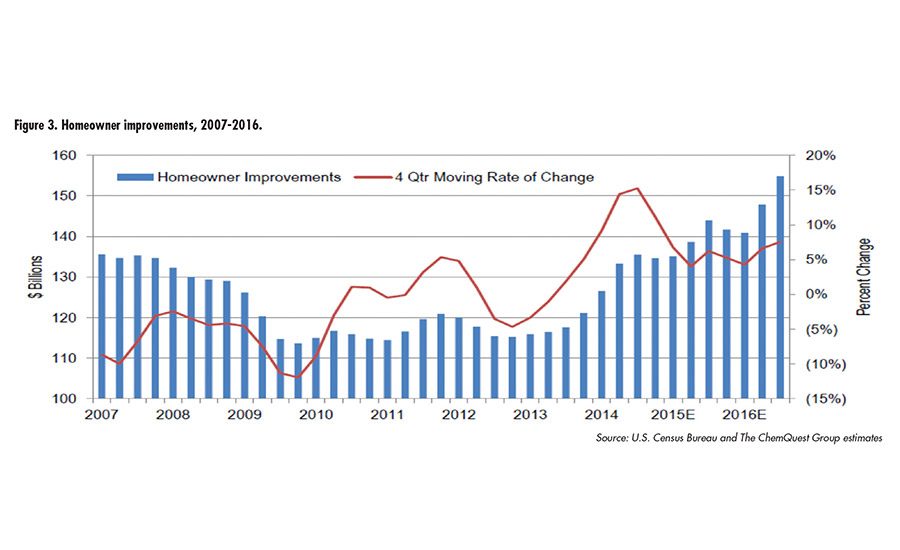

Consider the explosion of “new” floor coverings entering the market as illustrated in today’s floor covering trade magazines: Bamboo, cork, rubber, luxury vinyl, new carpet backings, imported flooring, laminates, and floating floors (see Figure 1, p. 13, and Table 1). Admittedly, many of these offerings that are marketed as “new” have been around for years; however, demand for these products has skyrocketed due to wider consumer appeal (i.e., driven by popular home-improvement shows) and steady growth in the home sales and remodeling industries (see Figures 2 and 3). Floor covering manufacturers and dealers are doing a terrific job capitalizing on these consumer trends with spot-on advertising campaigns.

A Need for Innovation

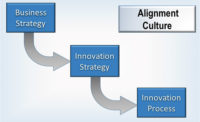

Adhesives are used to bond chemically treated subflooring and pads, as well as noise reduction membranes, ceramic tiles, porcelain tiles, resilient sheet and tile, and wood flooring of all types and sizes. Unfortunately, adhesive innovations may not be keeping pace with consumer demand in floor coverings. Criticism is mounting from the installation community due to a need for more installation-friendly adhesive products. In my 30 years of experience in the flooring industry, I see a need for adhesives formulators and their suppliers to be involved in all phases of formulation at the outset to ensure an innovative adhesive product for the intended application.

In my management role working for different adhesives formulators, we benefited from partnering with our raw material suppliers, and we were able to successfully leverage our supplier’s R&D capabilities. In return, we exclusively purchased our supplier’s technologies that were developed for us. As a result, our products could be brought to market faster. We also formed strategic alliances with select floor covering manufacturers. By doing so, we gained a thorough understanding of new flooring products in the early stages of development. Once launched, these often became the hottest flooring products on the market (with our adhesive sales in lockstep).

My observation is not novel, nor is it guaranteed to work for all formulators and suppliers. Nevertheless, it bears repeating that in the years I have worked in the flooring market, I have never seen a wider selection of flooring hitting the market (see Tables 2 and 3). These products require adhesives that offer superior bonding performance and installation flexibility. Can your company deliver? ASI

For more information, phone (513) 469-7555 or visit www.chemquest.com.