Broadly speaking, a market disruptor may include a technology, method, process, service, or channel with superior performance and customer benefits delivered at an attractive price point that can unexpectedly displace an incumbent. Porter’s Five Forces, created by Harvard Business School’s then-associate professor Michael E. Porter, Ph.D., has provided a framework for taking a “snapshot in time” of any potential threat to a business’ profits (not limited to a business losing its customers to an existing rival).

Clayton Christensen (Harvard Business School professor) set out in his book, The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail, to successfully leverage disruptive innovation. Put simply, Christensen identifies two types of new technologies: sustaining technologies, which incrementally improve existing products; and disruptive technologies, which change a product’s core features. The latter enter the market as cheaper but inferior alternatives, or they “underperform established products in mainstream markets.” At first, they attract only customers at the margins; over time, however, a disruptive product’s performance improves, and eventually becomes good enough for mainstream markets. Incumbents have plenty of time to figure out how to work with the new technology. The challenge is to figure out how to avoid cannibalizing existing markets.

While still an informative read, The Innovator’s Dilemma omits protection against being technologically blindsided by a “Big-Bang Disruption,” which is an entrant’s disruptive technology at launch that is both superior and cheaper vs. conventional (incumbent) technology. In this business scenario, incumbents can no longer safely follow Christensen’s advice and simply monitor the early progress of new entrants, confident in the knowledge that existing customers will delay switching.

Successfully thwarting a Big-Bang Disruption depends on staying ahead of (and rapidly responding to) megatrends and drivers.

The Rise of an Automotive Ecosystem

A standard passenger vehicle includes at least 30 computer processors; that number can rise up to 80 for high-end vehicles. Some of these processors add new functionality, such as voice recognition and assisted parking (and even accident safety and avoidance), while others have taken over the duties of older analog technologies like diagnostics, braking, and transmission. That said, disruption doesn’t end with a vehicle’s computer systems. An example from Microsoft is shown in Figure 1. Automotive design is also fully computerized, as is much of today’s testing.

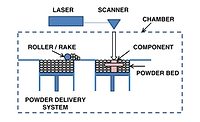

Early Adopters of 3D Printing

At Land Rover (now Jaguar Land Rover or JLR, part of Tata Motors), 3D printing did not merely disrupt development activities—it changed everything. For example, the development of casting applications achieved considerable time and cost savings while producing better test parts (see Figure 2). Today, JLR produces over 50,000 components annually. Each single plastic part design gets 3D printed to check tooling clearance, which means fewer mistakes.

Local Motors has a far-reaching vision for the future of automotive development and manufacturing. Its Strati is reportedly the world’s first 3D-printed car (see Figures 3 and 4). Remaining missing links in terms of increased uptake include the cost of materials, a need for injection thermoplastics for final production parts, design standards/guidelines for aftermarket, and standardization in material and processes and reliability.

Smart Roads “Talk” to Future Cars

Roads are becoming more intelligent. Southeast Michigan has developed “connected” roads and traffic signals designed with high-tech roadside barcodes for communicating warnings of abrupt highway condition changes that lie ahead to which the next generation of cars’ infrared light will be able to read and respond. Changing highway conditions may include active construction zones with workers, closed lanes, or a traffic signal that is about to turn red.

State agencies are reportedly working with carmakers and automotive suppliers in testing these types of life-saving technologies. According to The Detroit News, about 100 miles of “connected” highway corridors have been initially established with roadway sensors being tested in Metro Detroit (and a long-term target of up to 350 miles).

Material Advances

Metals and other materials are improving exponentially, which translates to fewer defects, longer vehicle lifespans, and simplified maintenance. Increased computerization of services, ranging from mining and global sourcing to international shipping, plays a role in the production of advanced materials. Basic research in alloys and composite raw materials is being revolutionized by exponential technology. Moreover, research in alternative fuels that may power the vehicles of tomorrow is also benefiting from exponential improvement.

Mobility Behavior by 2030

Up to one out of 10 cars sold in 2030 is projected to be a “shared” vehicle, which will lead to the rise of a market for “fit-for-purpose” mobility solutions (see Figure 5). These changes in consumer mobility behavior must be factored into long-term vehicle sales. Despite a shift toward shared mobility, ChemQuest forecasts continued growth in vehicle sales, but likely at lower rate of ~ 2% per year. By 2030, up to 15% of new cars sold could be fully autonomous, with electric vehicles becoming viable and competitive. ASI

Editor’s note: In our April issue, this two-part column will compare consumption trends in automotive powertrain adhesives and sealants to those of pure electric drivetrains. Emerging unmet user needs will be highlighted in automotive electronics and electrical controls, as well as in pure electric drive gearbox applications.