Report Evaluates Role of Renewable Carbon Feedstocks to Achieve a Net-Zero Chemical Industry

Image courtesy of the Renewable Carbon Initiative.

Image courtesy of the Renewable Carbon Institute.

Experts from nova-Institute, on behalf of the Renewable Carbon Initiative (RCI), prepared a new report titled Evaluation of Recent Reports on the Future of a Net-Zero Chemical Industry in 2050. The study builds on RCI’s work in introducing the concepts of renewable carbon and de-fossilization. It provides a critical assessment of net-zero visions for the chemical and plastics industries, evaluating available studies with net-zero 2050 visions and scenarios for chemicals or plastics, with a focus on overall growth and renewable carbon shares. After quality checks of available reports, 15 studies with a total of 24 scenarios were evaluated in regard to the relative contributions of non-fossil feedstocks and pathways projected for 2050.

Key Findings

In terms of industry growth projections, the majority of global scenarios anticipate continued growth in the production of the chemical industry. The average annual growth rate of the global feedstock demand for the chemical or plastics industry is projected at 2.9% (range 2%-4%). This indicates a slight deceleration compared to 3-4% compound annual growth rate (CAGR) observed in recent decades. Studies differ on the extent to which this growth will be offset by efficiency gains along the value chain. Overall, this translates into an approximate 2.4-fold increase in global feedstock demand from the chemical industry by 2050 compared to 2020 levels.

Notably, growth patterns show significant geographical differences. Most of the growth is expected to take place outside of Europe, and feedstock volumes in Europe are predicted to remain stable through 2050.

Renewable Carbon Shares

The analysis reveals a clear trend toward de-fossilization. All scenarios include biomass and recycling as possible alternatives to replace fossil carbon, while two thirds also include carbon capture and storage (CCU). A complete de-fossilization is considered in 10 of the 24 scenarios. The remaining studies expect a residual share of fossil carbon feedstocks, and in those cases combine these processes with carbon capture and storage (CCS).

For the entire chemical sector, the average feedstock shares of 16 scenarios across nine reports are 22% biomass, 33% CCU, 20% recycling, and 24% fossil & CCS (see Figure 1).

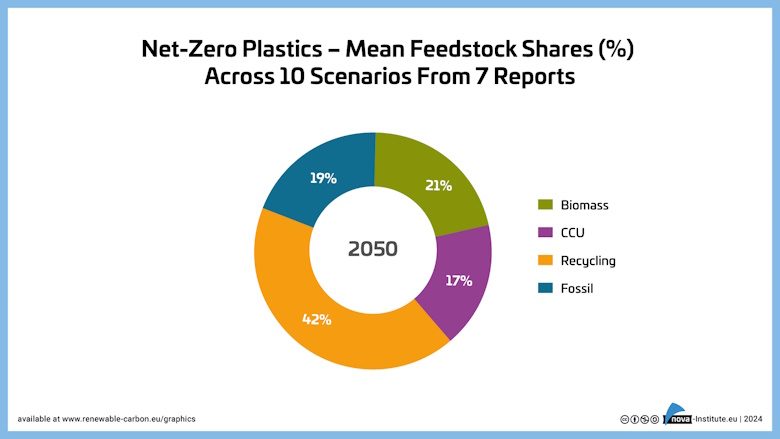

For the plastics sector, 10 scenarios across seven reports project shares of: 21% biomass, 17% CCU, 42% recycling, and 19% fossil and CCS (see Figure 2). Not surprisingly, the recycling rate for plastics is more than twice that of the chemicals sector as a whole. Plastics are easier to recycle and keep in circulation than other chemical products.

Implications for the Future

Despite variations in modelling approaches, assumptions, and scope, the results of the studies agree on a common vision: in a net-zero future, the chemical industry’s feedstock shifts dramatically away from fossil feedstocks. Biomass, CCU, and recycling are consistently identified as the pillars of this transition and beyond, with recycled feedstock projected as the main source of carbon for plastics production (see Figures 1 and 2).

While uncertainties remain about the volume of chemical recycling due to current low technology readiness levels, the results clearly show that maximizing carbon recovery and circularity of carbon can only be achieved by including and scaling chemical recycling.

This report provides insights for industry leaders, policymakers, and researchers working towards a net-zero future in the chemical sector. It highlights the urgent need for continued innovation and investment in renewable carbon technologies to meet the ambitious goals set for 2050.

Learn more at https://renewable-carbon-initiative.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!