Water-Based Adhesives Forecast to Match Industry Growth

Consumption of water-based adhesives in 1999 was 4.6 billion dry pounds valued at $2.6 billion. Volume growth through 2004 is forecast at a mature 2% annual rate, although the robust U.S. economy has contributed to higher rates in recent years. As opposed to other industries, such as coatings and inks, most of the adhesives industry is already environmentally compliant.

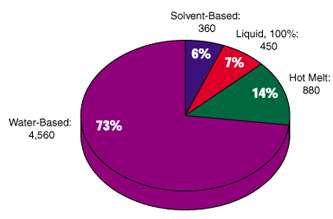

Hot melt technology is 14% of the industry volume, and 100%-solid liquid products are 7%. Solvent-based products represent only 6% of the volume, but 15% of the dollars. Figure 1 summarizes adhesive technologies in 1999 by weight.

Market Review

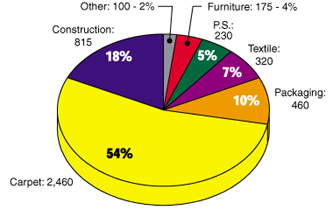

Six end-uses combine to capture 98% of the water-based adhesive poundage and 90% of the dollar value. Figure 2 outlines water-based adhesive poundage by market segment.Carpet backing is by far the largest-volume outlet comprising 54% of the weight. Carpet adhesives are employed during the manufacture of carpets and serve to hold the carpet fiber in place. Carpet-backing adhesives are highly filled, low-cost products and represent only about one-fifth of the water-based-adhesive dollars. Consumption is tied to carpet production, which is linked to the health of the housing and construction markets.

Construction is the second-largest end use accounting for 18% of the weight and nearly one-quarter of the dollars. A 3% annual rate of growth is projected for water-based construction adhesives. Construction adhesives are classified as either formulated, cementitious additive or binder. Formulated construction adhesives were 80% of the poundage. Some 90% of the formulated adhesives are used in flooring and ceramic-tile mastics. Flooring includes the gluing down of carpets, vinyl tiles and sheets, and wood strips or parquet panels. Ceramic tiles are also used in flooring, but additionally for walls.

Strong construction activity in recent years has boosted consumption of flooring adhesives, nearly all of which are water-based. Other larger formulated water-based construction-adhesive applications include glass insulation, and paper and vinyl wall coverings.

Cementitious polymer additives are 13% of the construction-adhesive volume. These polymer products serve to modify the physical, bonding and application properties of cement-based products. Exterior-insulating and finish systems (EIFS), ceramic-tile mortars and grouts, flooring underlayments, concrete-repair products, and bridge decks are outlets. Applications where water-based adhesives are classified as binders are wallboard-joint compounds and cellulose-insulation products. Both applications are mature.

Packaging is the third-largest end use in both volume and dollars, capturing 10% of the weight and 17% of the value. Water-based technology dominates in packaging, and a sluggish 1% annual rate of growth is forecast. Growing substitution of plastic packaging, which uses no adhesives, and the slight trend to hot melts, are negative growth factors for water-based adhesives.

A multitude of applications is included in packaging. Envelopes, bags, and paper cores and tubes are the three largest applications. Labels, corrugated-board manufacture, flexible packaging, towels and tissues, and paperboard-carton assembly are other larger applications. Flexible packaging and can sealants are faster growing areas for water-based technology, which are gaining at the expense of solvent-based products.

Nonwovens, high-loft and shoddy-pad products, and flocking are the textile outlets for water-based adhesives. Growth in nonwovens and high-loft and shoddy-pad products will trail that of the overall market because of a slight shift to processes that do not require adhesives.

Pressure sensitive products are rated fifth in poundage and dollars. The United States produced just over 12 billion square yards of pressure sensitive adhesive-coated products in 1999. Some 600 million dry pounds of adhesive were consumed, with water-based technology capturing 38% of the total.

About 60% of the water-based adhesive is used in labels and decals where a 6% annual rate of increase is forecast. Tapes took 23% of the water-based adhesives, mostly to coat polypropylene tapes. A more modest 3% growth rate is forecast for tapes.

Other water-based applications in pressure sensitive products include sound deadeners, shelf coverings, medical products and envelopes.

The furniture end use is also sometimes referred to as a broader “wood working” category. Water-based adhesives are used for paper and film overlays, doors, high-pressure laminates, and general assembly. Water-based furniture-adhesive technologies include emulsions, contact cements, polyurethanes and natural products (casein and animal glue). Water-based technology is three-quarters of the furniture-adhesive volume, and a 4% annual growth rate is forecast. Hot melts, 100%-solid liquids and solvent-based adhesives are also used for furniture.

Other end uses for water-based adhesives include consumer, automotive, bookbinding, footwear, foam fabrication and rubber-to-metal bonding. White and wood glues are larger-volume consumer adhesives. Glue sticks are a small-volume consumer application that is not thought of as being water-based, however about one-half of their formulation consists of water. Automotive applications for water-based adhesives are found in vehicle interiors and in tire manufacture.

Water-Based Adhesive Types

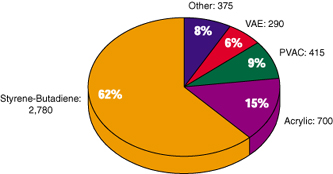

Most water-based adhesives are based upon emulsion polymers. Adhesives based on styrene-butadiene, acrylic, polyvinyl acetate (PVAC) and vinyl acetate-ethylene (VAE) combined are 92% of the water-based poundage and over 80% of the value. Figure 3 summarizes water-based-adhesive poundage by binder type. Carpet backing consumed 86% of the styrene-butadiene latex-based adhesives. Construction, automotive, textile and pressure sensitive products are smaller, but higher dollar-value end uses. A mature 2% yearly increase is forecast for styrene-butadiene adhesives.Acrylic adhesives are generally more expensive than styrene-butadiene types and although they are only about one-quarter the weight of styrene-butadiene products, they approach them in dollar value. Construction, pressure sensitive products and textile applications combine to take 95% of the acrylic volume. Ceramic-tile mastics are the largest-volume acrylic application in construction. Labels, decals and tapes are the biggest pressure sensitive product uses. Nonwovens, shoddy-pad and high-loft products, and flocking are the textile outlets. Acrylic products are projected to grow 3% annually.

Packaging and furniture are the leading applications for PVAC adhesives, combining for two-thirds of the weight. Packaging is forecast at a sluggish 1% yearly increase; furniture sees a more-modest 3% annual rise. Consumer use is found in white and carpenter wood glues. Textile usage is primarily in high-loft and shoddy-pad products where PVAC is expected to lose some ground to low-melt fibers. A 1% yearly growth rate is forecast for PVAC products.

VAE adhesives are found in a wide variety of end uses. Construction, packaging, carpets and textiles combine for about 85% of the volume. VAE competes primarily against PVAC and acrylic products. A 3% annual rate of increase is projected for VAE products.

Some 20 other water-based adhesive types are used. Low-cost products include starch, dextrin and sodium silicate. Polyurethane, polyvinyl pyrrolidone and polychloroprene are more-expensive types. Polyurethanes are advancing at a 5% yearly rate and are found in automotive, furniture and packaging applications. Polyvinyl pyrrolidone is used in consumer glue sticks where sales advanced rapidly in the 1990s. Polychloroprene is used for contact cements, and water-based versions continue to displace their solvent-based counterparts. Starch, dextrin and sodium-silicate products are employed in long-established packaging and construction applications and have little growth prospects.

Supplier Structure

Over 70 companies supply formulated water-based adhesives in the United States for the merchant marketplace. Merchant water-based adhesive sales are about $1.3 billion. H.B. Fuller and National Starch are the largest suppliers. Second-tier suppliers are Elmer’s Products, Armstrong, Henkel, Reichhold and Franklin. The top-10 merchant suppliers capture nearly 60% of the dollars; the top-20 some three-quarters of the dollars. Captive adhesive production is valued at roughly $600 million. Carpet backing is by far the largest captive end use. Automotive tire-cord bonding and some packaging, construction and flocking adhesives are produced in-house. In addition, over 20 firms manufacture polymers that are used essentially as non-formulated adhesives, or modifiers, for construction, pressure sensitive product, nonwoven and shoddy-pad applications. These non-formulated adhesives are valued at $650 million. Rohm and Haas, Air Products and National Starch are the largest suppliers.Outlook

Adhesives is the second-largest industry for water-based technology in dollar value, trailing only the coatings industry ($7.5 billion sales). In dry poundage, adhesive use exceeds that of the coatings industry (4.2 billion pound) and trails only paper coatings (8.1 billion pound). Water-based technology is already a large percentage of the adhesives industry and is forecast to match industry growth. Performance and application improvements have made the technology more viable in some demanding end uses. New products that offer better properties, or help in cost reduction, continue to gain.This article is based on Water Based Products, a 700-pg study available by subscription from Kusumgar, Nerlfi & Growney, One DeBaun Ave., W. Caldwell, NJ 07006; call 973-439-0030 or fax 973-439-0031.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!