Editor’sMemo

September 2002

Speaking to the Pressure Sensitive Tape Council (PSTC), I looked at key economic indicators as they relate to the pressure sensitive tape industry and advised manufacturers to act now to be able to be strong players in 2003 and beyond.

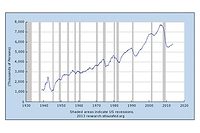

In what I would refer to as a “jobless recovery,” manufacturing and sales are in a slow, steady recovery, but not enough to reduce unemployment. Assuming no further terrorist activities, the recovery in manufacturing seen over the past six months will continue, which is what drives the pressure sensitive tape industry, its customers and their customers’ customers.

Various international factors come together to paint a cautiously optimistic picture of the next year. The fact that the euro is matching the dollar means that U.S. companies will enjoy profitability. U.S. goods are “on sale,” resulting in increased exports. Overseas profits will rise, and although imports to the United States will cost more, U.S. manufactured goods will be more attractive. 2003 European growth should be in the 3% range. Composite leading indicators (employment, sales and income) have moved upward, and forward-looking indicators are already showing strength. Planners should use the lower range estimate of +1.0% in 2002 of forecasts for good, prudent internal business planning as it relates to European markets. Sales predictions, though, should use more optimistic numbers of +1.5%.

Asian growth is beginning to emerge. U.S. manufacturers need to be ready for its economic recovery. Moderate improvement should be expected in 2003, and companies must put structures in place now to be able to move quickly when the +6.0% growth happens in China, India, Malaysia, Singapore and South Korea.

NAFTA has signaled growth for the next six quarters. The last two quarters of 2002 show growth, and it is expected to continue. Unemployment, though, is a reason to proceed cautiously in these markets. Global prospects will obviously be important to the PSTC and its member companies. The minimum sales performance planners should expect next year is growth to equal the gross domestic product — 3%, at pace with the world economy.

Planners should question the data, both internal and external, on which they base their activities: Where did it come from? Is it accurate? Companies will need to control and contain costs, and to do so, will need to collect accurate information. While government data is abundant, the most trustworthy data comes from your trade association where members know each other and know the processes and procedures of their colleagues and their data-collection methods.

The good news is for continued industrial production growth. While growth may not come from new products, it will come from multinational companies with markets in Europe and Asia, and from the public utilities, public health, security and healthcare industries. The key to success will be keeping close to the customer in preparation for 2003. Get ready now. Be the key supplier. Contain costs. Communicate with your customer — and plan for moderate growth.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!