STRATEGIC SOLUTIONS: The U.S. Adhesives Industry

It is likely that 2006 will be another year of steady growth, despite the uncertainties accompanying a slowing economy, rising interest rates, the price of oil and geopolitical unrest. It is difficult to estimate the growth or decline in any given year; however, ChemQuest believes that the U.S adhesives industry will probably average growth of 3-3.5%/year over the next 5-10 years.

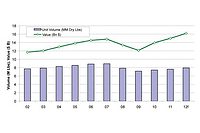

Figure 3 (bottom). Adhesives Industry Market Sectors

- Replacement of mechanical fasteners

- Weight reduction and fuel efficiency demands resulting in downgauging, downsizing, and use of dissimilar substrates such as plastics and hybrid metal alloys in design (making it more difficult to fasten using conventional mechanical means)

- Robust construction growth

- More imports of finished goods

- Escalating raw material and labor costs

- Advancements in medical applications such as prosthetics, drug delivery, dental and disposable medical devices

- Diffusion of computer and electronic usage throughout new product design.

While these are positive trends, they are somewhat mitigated by globalization and geographical realignment of labor-intensive manufacturing to emerging regions - such as China, India, Vietnam, Thailand and the Philippines - impacting businesses for textiles, wood, appliances, electronics, automotive, sporting equipment, and other product assembly applications.

Because of these drivers, the trends that will likely result include:

- Higher speeds and process efficiency

- Greater control in the application of adhesives

- Higher use of recycled fiber, wood and plastics

- More reformulation to reduce material costs and energy costs

- Greater use of lower cost substrates, composites and laminates

- Greater use of thinner gauge substrates

Market Segments

The U.S. adhesives industry is somewhat similar to the coatings industry (also based on formulated products), with many of the same drivers. However, adhesives are more fragmented than coatings, with many market sectors. Since the majority of adhesive market applications involve fastening functions, adhesives should properly be considered a component of the fastening industry and will often compete with other mechanical fasteners. The detailed segmentation of the adhesives and sealants markets is shown in Figure 3.

Leading Producers

The adhesives industry is not only fragmented by market segments, but also by the large number of adhesive manufacturers that supply products to it. Some estimate the number of players to be more than 500! The majority of the leading producers show high single-digit growth, a trend that reflects rapid price increases to keep pace with the rising costs of raw materials. In 2005, Henkel continued its aggressive acquisition strategy, growing its sealants business by 25% with the acquisition of OSI. The six leading producers are shown in Table 1.

Recent M&A Activity

Modest M&A activity took place in 2005, with the major acquisitions on the sealant side of the business, led by BASF's acquisition of Degussa's construction chemicals and sealants business and DAP's acquisition of Illbruck's sealant business (see Table 2).The adhesives side of the business saw little activity, with the exception of ITW's acquisition of Permatex and Itochu's recent acquisition of Reynolds. To date, 2006 activity has been equally robust. We anticipate M&A activity to exceed 2005 barring a major economic slowdown.

Industry Margins

Adhesives and sealants face tough raw material headwinds. Despite price increases of 50% in some regions since early 2005, adhesive pricing has lagged raw material increases by ~3-6 months and gross margins have fallen, down ~6-9% since early 2005. Although raw materials appear poised to stabilize after rising an estimated 6-8% in Q2' 06, they should do so at a higher level than current prices, which should further pressure adhesives. It is important to note that shortages for key raw materials such as isoprene and dicyclopentadiene (DCPD), among others, are also hurting growth.Key feedstocks experiencing significant escalation and/or shortages include:

- Rubber - natural and synthetic

- Ethylene - acetal value chains

- Propylene - acrylic value chains

- TDI/MDI

- Tackifiers and plasticizers

Raw-material costs for the adhesive companies are the largest component, representing about 53-59% (see Figure 5) of revenue or more than three quarters of COGS.

While adhesive formulators generally suffer a margin squeeze during times of rapid raw material price increases, they tend to do well on the back side of the economic cycle. Therefore, they may experience an expansion of margins of 6-9% in 2007 and into 2008 when additional crude oil capacity comes on stream.

Dan Murad is president and CEO of The ChemQuest Group Inc., an international strategic management consulting firm specializing in the adhesives, sealants, and coatings industries, headquartered in Cincinnati.

For more information, phone (513) 469-7555 or visit http://www.chemquest.com .

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!