2015 Materials and Chemicals Overview

Demand for many materials and chemicals is expected to rise.

Specialty Chemicals

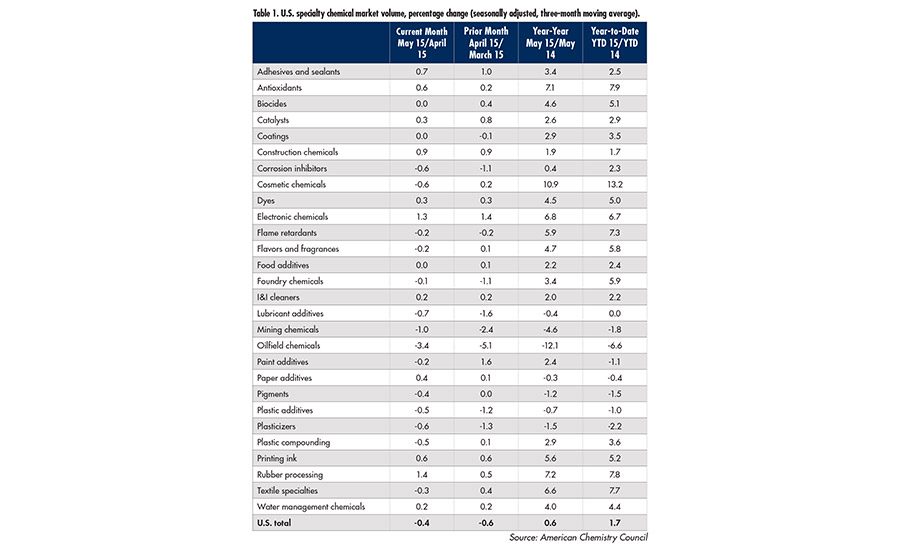

The “Specialty Chemicals Market Volume Index,” a new tool created by the American Chemistry Council (ACC), remains on a soft note, falling 0.4% in May from the previous month, on a three-month-moving average (3MMA). This follows steady declines since December 2014, as weakness in oilfield chemicals and a few other segments weighed on overall volumes. Of the 28 specialty chemical segments monitored, 11 expanded in May, 14 declined and three were flat.

The overall specialty chemicals volume index was up just 0.6% year-over-year (Y/Y) also on a 3MMA basis (see Table 1). Year-earlier comparisons were generally in the 4-6.8% range since January 2012, but since February of this year they have been below that range as the downturn in the oil and gas sectors affected headline volumes. Still, on a Y/Y basis, gains are fairly widespread among most market and functional specialty chemical segments and, in some cases, they are improving. Compared to last year, May volumes were up in 21 segments and down in only seven segments. Year-earlier comparisons have clearly moderated. Similar patterns were seen in year-to-date (YTD) comparisons.1

Global demand for specialty chemicals is expected to grow at a compound annual growth rate (CAGR) of 5.42% from 2015 to 2020, according to “Specialty Chemicals Market by Type, by Function—Global Trends & Forecasts to 2020,” a study from Markets and Markets. The Asia-Pacific region remains the largest market for specialty chemicals in terms of value, followed by North America. The Asia-Pacific market is projected to register good growth due to the positive demand in end-user industries such as construction, automotive, plastic, and electronics.2

Catalysts

Thanks to global economic conditions brightening again, demand for catalysts is on the rise. According to Ceresana, global catalyst revenues are forecast to rise to approximately $22.4 billion until 2021.

In 2013, North America was the largest consumer of catalysts, due to an extensive petrochemical sector. Accounting for a market share of 42%, North America consumed a higher amount than the high-growth Asia-Pacific region. Demand in Western Europe, however, is anticipated to fall, reportedly due to the region’s preference for renewable energy in an effort to reduce the dependency on crude oil and for reasons of environmental protection.

The U.S. is by far largest consumer of catalysts. The amount of crude oil processed using catalysts in the U.S. is especially high. China ranked second; with an expected average annual growth rate (AAGR) of 4.5% per year, this country is likely to experience the most dynamic development of all 20 countries included in the study. Development in Spain and Italy, on the other hand, is expected to proceed much differently: These countries, affected by the euro crisis, are faced with the challenges of having to rebuild flagging industrial sectors and offering jobs to young people in order to prevent an emigration of knowledge.3

Defoamers

The global market for defoamers is forecast to reach $3.9 billion by 2020, according to “Defoamers: A Global Strategic Business Report,” a recent report by Global Industry Analysts Inc. Growth will reportedly be driven by a resurgence in demand from end-use markets, as well as increasingly stringent environmental regulations.

Demand for defoamers fluctuates in close correlation to global and national GDP growth patterns, according to the report. The market as a result remains vulnerable to economic cycles. Demand particularly from key end-use industries therefore declined during the 2007-2009 recession period. Recovering from the recessionary lull, the global anti-foaming agents market is expected to witness steady growth over the next few years, primarily driven by expanding applications of chemical additives.

In addition, encouraging gains in global manufacturing are signaling an optimistic outlook for defoamers, given their use in diverse manufacturing industries. An influx of innovative and high-performance defoamers represents another significant fact for promoting market growth. The increasing rate of R&D activities, technological advancements and product innovations are helping expand the use of defoamers in potential industrial applications.

Europe represents the largest market worldwide, followed by the U.S., according to the report. Asia-Pacific represents the fastest-growing market with a CAGR of 4.2% over the analysis period. Considerable growth in oil and gas, automotive, printing inks, coatings, pulp and paper, construction materials, and other key manufacturing sectors, along with growing population, increased urbanization, infrastructure development and robust pace of industrialization, reportedly represent key growth drivers in the region.4

Rheology Modifiers

The rheology modifiers market is projected to register a CAGR of 3.3% between 2015 and 2020, and is expected to be worth $5,600 million by 2020, according to “Rheology Modifiers Market by Type & Application—Global Trends & Forecasts to 2020,” a report from Markets and Markets. The Asia-Pacific region is the largest market for rheology modifiers, and is projected to retain this position over the next five years. This is because the region is the highest producer—as well as consumer—of coatings across the globe. The growing coatings market is reportedly driving the demand for rheology modifiers in Asia-Pacific, because coatings comprise their largest application.

The major driving factors of this market include the growth of end-user industries for coatings, adhesives and sealants applications. Moreover, the population’s changing lifestyle and increasing purchasing power has led to greater demand for cosmetics products, which is also driving the growth of the market. The market is restrained due to various factors, such as the shift from print to digital media in the inks market, as well as declining R&D investments in the pharmaceutical industry.5

Surfactants

The global surfactants market is estimated to grow at a CAGR of 5.3% by volume (5.5% by value) during the forecast period of 2015 to 2020, according to “Surfactants Market by Product Type, by Substrate Type, by Application—Trends & Forecast to 2020,” a recent report from Research and Markets. The global surfactants market is projected to reach a volume of 24,037.3 kilotons (KT) and a value of $42,120.4 million by 2020. The anionic surfactants segment dominated the global market in terms of volume, with 7,686.1 KT in 2014, followed by the non-anionic surfactants, the volume of which was recorded at 6,345.7 KT in the same year. The amphoteric surfactants segment, with a share of 7.2% of the global market in 2014, is projected to grow at the highest CAGR during the forecast period of 2015 to 2020, as compared with the anionic, non-anionic, and cationic surfactant segments.6

With a world market share of more than 36%, the Asia-Pacific region has the highest demand for surfactants, according to Ceresana. Different products dominate different regions; Asia currently reaches a market share of more than 43% with alkyl benzene sulfonate, while consumers in Western Europe and North America consume primarily alkylsulfates, alkyl ether sulfates, and alcohol ethoxy sulfates, with a share of around 62%.

Surfactants are most commonly used as cleaners and detergents. In 2014, around 56% of total demand accounted for this segment. Surfactants are also used in cosmetics and textiles, such as in printing ink and lubricants. The coatings and plastics markets are expected to grow the most: 2.6% per year until 2022.7

Resins

The global value of the adhesive resin market was estimated at approximately $11.3 billion in 2015, according to Markets and Markets’ report entitled “Adhesive Resin Market by Technology, by Chemistry, and by Application—Global Forecast to 2020.” The market is projected to reach $14.3 billion by 2020, growing at a CAGR of 4.88% between 2015 and 2020.

The increasing use of adhesives in automotive manufacturing contributes to overall growth in the global adhesive resins market. The construction, automotive, and medical adhesives markets have all seen growth or resurgence that is contributing to a projected increase in the worldwide market for adhesive resins. While the use of adhesives was previously limited by environmental concerns and regulations, recent the development of bio-based, ecologically friendly adhesives and solvent-free adhesives has removed many of these barriers. Specialty engineering adhesives are now in demand for automotive assembly and aircraft manufacturing, according to the report.8

The global epoxy resins market was valued at $6.64 billion in 2013 and is expected to reach $10.55 billion by 2020, growing at a CAGR of 6.9% between 2014 and 2020, according to Transparency Market Research’s report entitled “Epoxy Resins Market for Paints & Coatings, Wind Energy, Composites, Construction, Electrical and Electronics, Adhesives and Other Applications—Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2014-2020.”

The global epoxy market is being driven by growing demand for paints and coatings from several industries. Additional factors contributing to the growth of the global epoxy resins market include demand for resins from the wind energy sector and aerospace industry. However, the epoxy resins market faces certain challenges, including high demand for a few raw materials such as epoxy resins for the production of bisphenol, and fluctuating prices. As the end-use industries continue to grow and the global economy shows a promise of recovery, the global epoxy resins market is also expected to tread a path of growth in the coming years.9

Silicones

World silicones demand is forecast to rise 5.7% per year to $19.3 billion in 2019, according to “World Silicones,” a recent study from The Freedonia Group Inc. The pace of growth in value terms will be in line with that seen over the 2009-2014 period, largely due to an improved outlook for silicone prices. Demand for silicones in developing regions is expected to post strong gains through 2019, benefiting from economic advancement and increased penetration of silicones in less mature markets (see Table 2).

The Asia-Pacific region is expected to continue to be the strongest source of additional silicone demand, accounting for 57% of the total increase in global silicone consumption between 2014 and 2019. The bulk of these gains will be attributable to China, which will represent nearly three-fifths of the Asia-Pacific total in 2019.

“Although China’s silicone market will not maintain the extremely rapid pace of gains seen in recent years, growth will still continue to be well in excess of the global average,” said Elliott Woo, analyst. Other developing countries in the Asia-Pacific region, such as India, Indonesia, and Thailand, are also expected to post strong gains in silicone demand. Electrical and electronic products will remain the largest outlet for silicones in the Asia-Pacific region, reflecting the region’s dominance in global electronics manufacturing.

The outlook for silicone demand in North America and Western Europe is somewhat weaker, reflecting the maturity of both manufacturing industries in general and the use of silicones. In the U.S. market, the largest in the world, demand for silicones will be bolstered by a major improvement in construction activity. Demand for silicones in Western Europe will advance slowly, although the region’s affluence will continue to support significant demand for silicones in the health and personal care market. Above-average growth is expected in the Africa/Mideast region, aided by urbanization and the emergence of the middle class in some of the more developed nations. Gains in silicone demand in Central and South America will be near the world average, benefiting from a rebound in motor vehicle production from low 2014 levels. Gains in Eastern Europe are expected to be slightly below the world average, but will still represent a healthy increase through 2019 as export-oriented manufacturing activity continues to grow.10

Titanium Dioxide

According to “Titanium Dioxide Market-Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2014-2020,” a report from Transparency Market Research, the global titanium dioxide market was valued at $13.14 billion in 2013 and is anticipated to reach $17.12 billion by 2020, expanding at a CAGR of 3.8% in that period.

Demand for lightweight vehicles has increased due to the rising demand for fuel-efficient vehicles. This trend is estimated to continue during the forecast period. Polycarbonate is used as a substitute for metal and glass-based automotive parts in lightweight materials. However, polycarbonate’s low scratch resistance has restrained its market growth. Titanium dioxide is a major coating materials used to coat polycarbonate. Thus, rising demand for lightweight vehicles, coupled with increasing demand for polycarbonate, has been a major factor driving demand for titanium dioxide.

Demand for titanium dioxide nanoparticles has increased in recent times, according to the report. This is projected to drive growth of the titanium dioxide market during the forecast period. There has been an increase in the number of stringent regulations in the titanium dioxide market due to environmental and health hazards associated with titanium dioxide. This is one of the major factors hampering demand for titanium dioxide. Rising demand for coatings in photovoltaic modules to increase their efficiency is likely to offer high growth opportunities in the titanium dioxide market.

Based on application, demand for titanium dioxide has been segregated into four major segments: coatings, plastic, paper, and others. Coatings represented the largest application segment for titanium dioxide in 2013, accounting for over 50% of the market share in the same year. This trend is expected to continue during the forecast period.

Asia-Pacific dominated the global titanium dioxide market, with a share of over 40% in 2013. This trend is estimated to continue during the forecast period. Asia-Pacific is projected to be the fastest-growing region in the next few years due to high growth in several end-use industries in the emerging economies of India and China.11

References

1. www.americanchemistry.com/Media/PressReleasesTranscripts/ACC-news-releases/US-Specialty-Chemicals-Market-Softens-In-Second-Quarter-2.html (published June 2015), American Chemistry Council.

2. “Specialty Chemicals Market by Type, by Function—Global Trends & Forecasts to 2020” (published June 2015), Markets and Markets, www.marketsandmarkets.com/Market-Reports/global-specialty-chemicals-165.html.

3. “Market Study: Catalysts” (published May 2014), Ceresana, www.ceresana.com/en/market-studies/chemicals/catalysts.

4. “Defoamers: A Global Strategic Business Report” (published April 2014), Global Industry Analysts Inc., www.strategyr.com/Defoamers_Anti_Foaming_Agents_Market_Report.asp.

5. “Rheology Modifiers Market by Type & Application—Global Trends & Forecasts to 2020” (published June 2015), Markets and Markets, www.marketsandmarkets.com/Market-Reports/rheology-modifier-market-223566264.html.

6. “Surfactants Market by Product Type, by Substrate Type, by Application—Trends & Forecast to 2020” (published June 2015), Research and Markets, www.researchandmarkets.com/research/lbwl65/surfactants

7. “Market Study: Surfactants (2nd Edition)” (published April 2015), Ceresana, www.ceresana.com/en/market-studies/chemicals/surfactants.

8. “Adhesive Resin Market by Technology, by Chemistry, and by Application—Global Forecast to 2020” (published July 2015), Markets and Markets, www.marketsandmarkets.com/Market-Reports/adhesive-resins-market-13352119.html

9. “Epoxy Resins Market for Paints and Coatings, Wind Energy, Composites, Construction, Electrical & Electronics, Adhesives and Other Applications—Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2014-2020” (published July 2014), Transparency Market Research, www.transparencymarketresearch.com/epoxy-resins-market.html.

10. “World Silicones” (published May 2015), The Freedonia Group Inc., www.freedoniagroup.com.

11. “Titanium Dioxide Market—Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2014-2020” (published July 2014), Transparency Market Research, www.transparencymarketresearch.com/titanium-dioxide-market.html

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!