Market Trends

Convertible Flexible Packaging Demand Increases

Growth areas for flexible packaging include both food and nonfood applications.

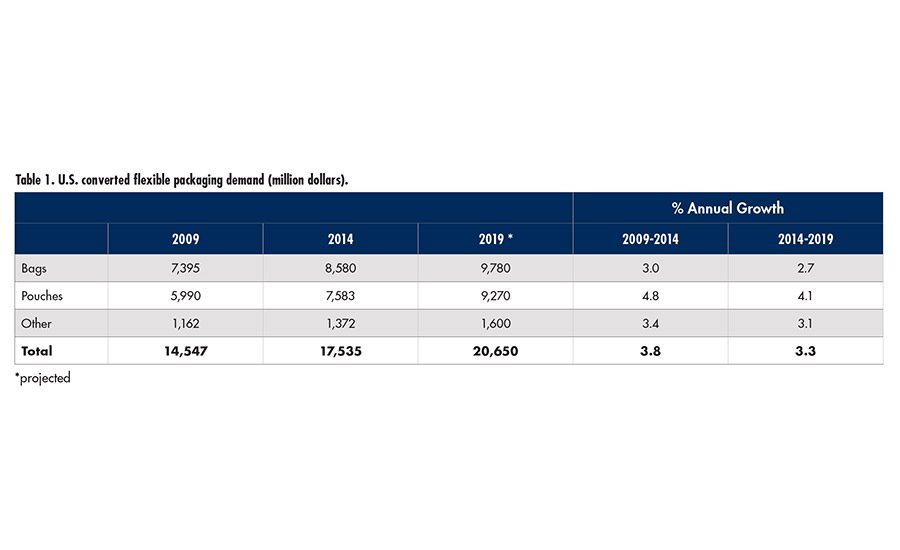

Demand for converted flexible packaging in the U.S. is projected to increase 3.3% annually to $20.7 billion in 2019. Although advances will decelerate from the pace of the past decade, converted flexible packaging will remain a growth area in both food and nonfood applications due to the inherent cost and performance advantages of lightweight bags and pouches. Moreover, converted flexible packaging’s source reduction, space savings, and lower production and transportation costs are expected to be increasingly advantageous in light of the growing importance among major retailers and packaged goods firms of supply chain sustainability as a competitive advantage. All of these factors will drive further conversions from rigid to flexible formats. These and other trends are presented in “Converted Flexible Packaging,” a recent study from The Freedonia Group Inc.

Pouches will experience above-average gains, reflecting continued opportunities in both food and nonfood segments and for new conversions from rigid packaging. “Growth will benefit from the increased prevalence of value-added features, such as spouts and fitments, as well as the development of newer stand-up pouch designs that can contain heavier weight contents,” said Esther Palevsky, analyst.

Bag demand is expected to rise more slowly due to the maturity of a number of applications, competition from pouches, and, to some degree, rigid packaging such as clamshells and blister packaging. Overall advances will be helped by growth in food production, an expanding elderly population, and the importance of bags for bulk and other larger-sized packages in such markets as pet food, chemicals, building materials, and agricultural and horticultural products.

For more information, visit www.freedoniagroup.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!