Mergers and Acquisitions in Adhesives and Sealants: 2015-2016 Review and Forecast

Recovering end markets are contributing to increased merger and acquisition activity in adhesives and sealants activity.

To say that the state of merger and acquisition (M&A) activity in the adhesives and sealants industry is “strong” or “robust” would be misleading. In actuality, the M&A markets may have never been stronger. Among adhesive and sealant formulators, we counted 29 deals in 2014 and 37 in 2015; with 21 so far this year (through June), it appears that 2016 may be on track to be a record year. More than half of the companies in the ASI Top 25 (see p. 14) completed transactions in 2015, with several (e.g., Sika, RPM, H.B. Fuller and Royal Adhesives) making multiple acquisitions.

This level of activity should not be surprising; the economic backdrop is nearly ideal. Corporate balance sheets are strong, private equity groups are flush with cash, and relatively inexpensive credit is accessible. Important end markets for adhesives also appear to be recovering faster than other sectors of the economy. A few large deals have taken place in the past few years, including Arkema’s purchase of Bostik for nearly $2 billion and Solvay’s acquisition of Cytec for more than

$6 billion. Large transactions such as these tend to generate additional M&A activity, either in the form of corporate carve-outs or as other industry participants ramp their own M&A programs to remain competitive.

Most adhesives and sealants deals since the start of 2015 have been “bolt-on”-type transactions, with buyers purchasing synergistic companies to build scale and market focus. We have also been seeing more corporate carve-outs as large firms attempt to optimize their portfolios. Both types of deals are usually relatively small in size, typically with enterprise values under $100 million (and many less than $50 million), but they can be highly strategic for buyers that seek to consolidate market positions, benefit from new technologies or extend their geographic reach.

Important End Markets a Source of Strength

Not surprisingly, companies focusing on the construction and automotive sectors, both big markets for adhesives and sealants, have been performing well, and have been key targets for acquirers. Housing and construction spending have been bright spots in the recovery for a few years now. Indicative of the current strength in the housing markets, year-to-date new home sales through May are up 6.4% over the same period a year earlier. Longer term, single-family housing starts have been growing on average 13.6% per year since the end of the recession in 2009 (see Figure 1, p. 24).

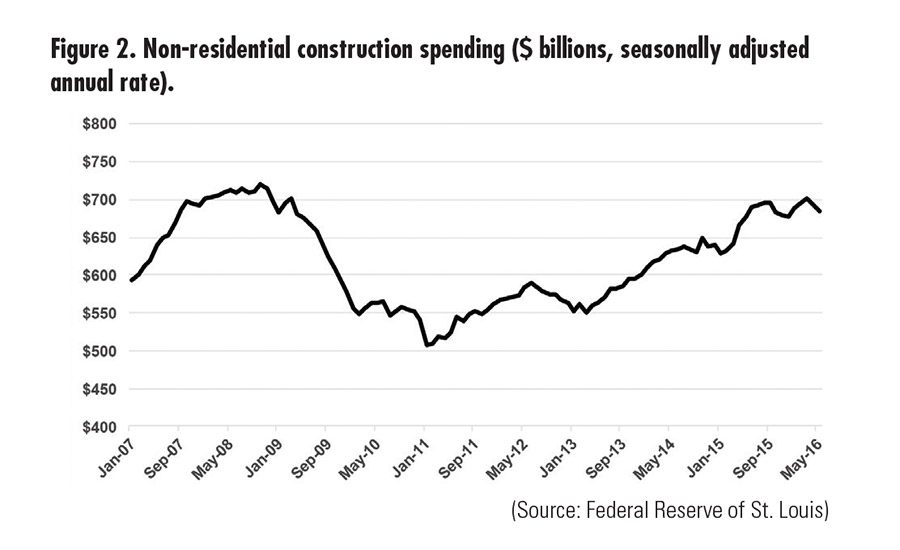

And it’s not just housing: all U.S. non-residential construction spending has been growing at a 6.3% annual rate since bottoming in 2011 (see Figure 2, p. 24). Given these tailwinds, large buyers have been actively acquiring companies serving the construction markets. Both Sika and RPM completed multiple construction adhesive and sealant deals in 2015 and 2016. In April 2016, SOPREMA announced it had acquired Chem Link, a Michigan-based manufacturer of high-performance adhesives, sealants, and coatings for roofing, waterproofing, and other construction applications.

The automotive sector represents another important end market with bright growth prospects for adhesive and sealant companies. According to The Adhesive and Sealant Council, the global market for automotive adhesives is expected to increase 8.2% annually through 2020, driven by underlying growth in vehicle sales and the automotive industry’s ongoing efforts to improve fuel efficiency through weight reduction. In 2015, PPG acquired Le Joint Francais and REVOCOAT, both of which provide adhesive and sealant technologies to the automotive industry. Continued strength in automotive sales could set the stage for further M&A activity among adhesives and sealants suppliers to this key segment.

Another key area for M&A activity has been the engineering adhesives segment, a rapidly growing $12 billion market that includes electronics, automotive, energy, and other industrial applications. As an illustration, earlier this year Royal Adhesives acquired Adhesive Systems Inc., a maker of cyanoacrylate, methyl methacrylate, epoxy, anaerobic and other adhesive products used in assembly operations in the automotive, aerospace/aviation, medical equipment, military, electronics, and other industrial markets. Other major players in the engineering adhesives market, including Henkel, Lord, and 3M, are other likely suitors for acquisition targets in this attractive segment.

Fragmented Industry Provides an Ideal Environment

The evolving structure of the adhesives and sealants industry itself is conducive to a high level of M&A activity. With just six companies currently accounting for about 40% of the global adhesive and sealants market value, the remaining 60% consists of hundreds (or more) of small- and medium-sized companies that form a diverse pool of attractive acquisition candidates. Relatively few of these companies have revenues over $100 million, and with the availability of debt at low interest rates and balance sheets rich with assets to use as collateral, both traditional and private-equity backed strategics have the opportunity to pursue multiple, highly strategic “bite-sized” targets with minimal risk. These buyers can have a strong ability to generate meaningful synergies in raw material purchasing, sales and marketing, manufacturing, and in other areas. This classic “bolt-on” strategy can help buyers justify smaller transactions, as they can make an outsized impact to a buyer’s bottom line after integration synergies.

Private equity buyers have played an increasing role in specialty chemicals M&A activity, accounting for 20-25% of chemical industry transactions in recent years. Generally stable cash flows, the opportunity to grow through acquisitions, and a fragmented industry have made the adhesive and sealant market highly attractive to a number of private equity firms that are actively executing “roll-up” strategies and blurring the line between the meaning of “private equity” and “strategic.” A prime example of this development is American Securities-backed Royal Adhesives, a “serial” acquirer that has been executing a roll-up strategy in adhesives and sealants for more than 10 years, targeting smaller companies that can provide access to new technologies or markets while leveraging its growing global sales, marketing, and manufacturing capabilities. Royal has completed 18 acquisitions since 2003, including the purchase of Advanced Polymers International (microsphere-based adhesives) and Chemical Innovations Ltd. (high-performance automotive and industrial adhesives) in 2015. In early 2016, in addition to the Adhesives Systems deal previously mentioned, Royal acquired Weld Mount Systems, strengthening its presence in structural and assembly adhesives. Royal itself went through a sale process in 2015, with private equity group Arsenal Capital Partners (New York) selling the company to American Securities (New York) in June.

Other emerging quasi-strategic private equity groups include Audax Group (Boston), which formed Innovative Chemical Products Group (ICP Group) early this year, and Arsenal Capital-backed Accella Performance Materials. The first acquisition within ICP Group’s adhesives and sealants division was the February purchase of 3M’s pressurized polyurethane foam adhesives business, formerly known as Polyfoam, which provides polyurethane-based adhesives and insulation for the construction and industrial markets. ICP followed up this deal with the acquisition of Fomo Products, which strengthens ICP’s position in polyurethane adhesives and sealants and which was highly complementary to the acquired 3M business. Accella Performance Materials also has focused on polyurethane technologies through a rapid pace of acquisitions that include three deals announced in September 2015: Premium Spray Products, Burtin Polymer Labs, and Coating & Foam Solutions. The acquired companies produce spray foams for insulation, roofing, and other specialty applications. This past March, Accella announced the purchase of Quadrant Urethane Technologies Spray Foam Division (Quadrant Spray Foam).

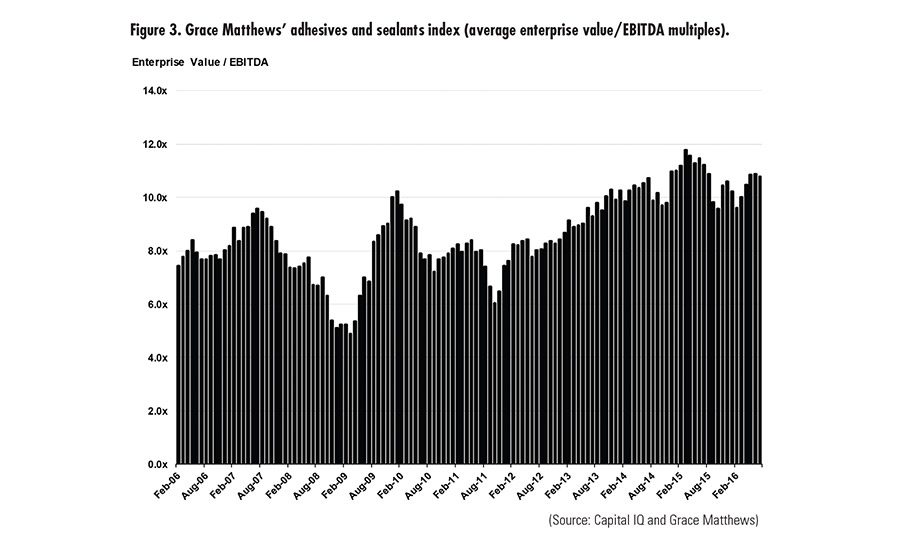

Strategic buyers have had a strong appetite for acquisitions in 2015 and 2016, driven by strong balance sheets and the need to demonstrate growth amid a generally low-growth environment. Enterprise value/EBITDA multiples for publicly traded adhesive and sealant companies reached multi-year highs in 2015 (see Figure 3), and companies must show consistent earnings growth to maintain multiples at these levels. Acquisitions, especially those immediately accretive to earnings, are one way to achieve earnings growth.

Most of the publicly traded adhesives and sealants companies are multi-national operations, and they have an advantage in their capability to more easily acquire and integrate companies in overseas geographies that may not be as accessible to smaller domestic-only players or private equity groups. Our discussions with major adhesive and sealant companies indicate that they have an ongoing interest in international bolt-on acquisitions that can fill gaps in product lines, expand their geographic footprint, and augment lower growth rates in domestic markets.

A review of 2015 and 2016 M&A activity by large strategics confirms this trend, and reveals a large number of cross-border acquisitions. For example, in February 2015, H.B. Fuller completed the acquisition of Tonsan Adhesive, the largest independent engineering adhesives provider in China, with annual revenue of about $100 million at the time of the deal. Tonsan offers a range of silicone, epoxy, anaerobic, and cyanoacrylate technologies for automotive, electronics, and solar markets. While the purchase price was more than 12 times EBITDA, the acquisition was highly strategic in that it facilitated H.B. Fuller’s entry into this growing global market. Other examples of international deals include Sika’s purchase of Construction Technologies Australia, which supplies tile adhesives and mortar products to the Australian market, and H.B. Fuller’s acquisition of Continental Products Limited, which manufactures industrial adhesives in Africa, and its purchase of the Australian industrial adhesives business Advanced Adhesives.

Valuations Remain High

As noted earlier and as shown in Figure 3, public company valuations attained a multi-year high in 2015, peaking at 11.8 times EBITDA in March. Despite retreating from 2015 highs, public-company multiples as of mid-2016 remained 30-40% above historical averages. Private, middle-market transactions are generally valued at a discount to publicly traded companies, but in 2015 and 2016 we have been seeing middle-market (enterprise values between $50 and $500 million) valuations for high-quality specialty chemical transactions at multiples in the range of eight to 10 times EBITDA with some larger, highly synergistic deals exceeding 10 times. Adhesives and sealants firms are no exception and have been one of the more active areas in chemical M&A.

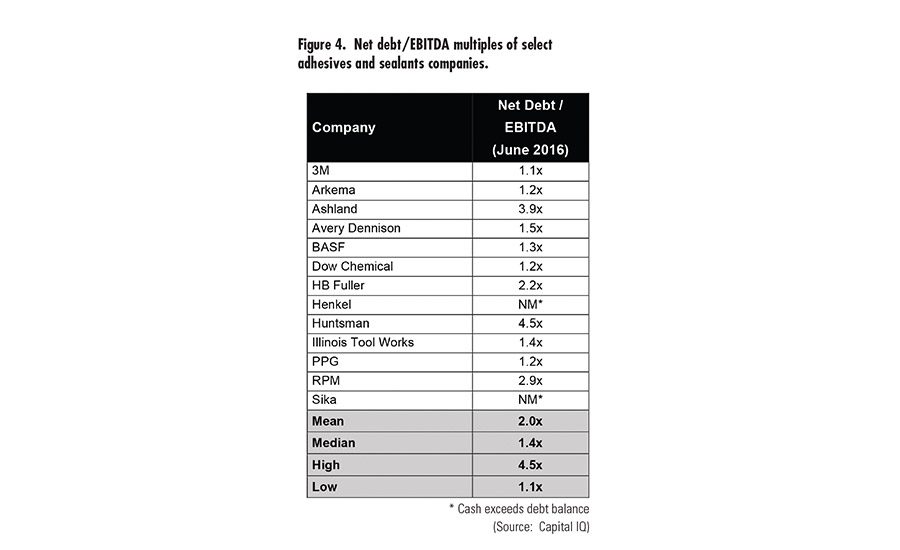

Somewhat counterintuitively, the slow pace of the economic recovery itself contributes to high valuations. With many end markets growing at GDP-type rates, companies turn to M&A to fuel the earnings growth that investors demand. Access to credit and strong balance sheets also play a role. As shown in Figure 4, balance sheets for major adhesive companies show net debt (total debt less cash reserves) of less than two times EBITDA. Healthy cash balances for public companies provide ample funding for bolt-on acquisitions, and historically low debt levels provide significant flexibility to fund larger acquisitions or multiple smaller ones. For private equity buyers that have to rely on bank financing to complete deals, lending multiples totaling more than six times EBITDA for large, high-quality companies are not uncommon, while smaller companies (under $100 million in enterprise value) may still obtain 3 to 4 times or more. All of this adds up to a very competitive M&A market for adhesive and sealant companies.

Looking Ahead

For the remainder of 2016 and into 2017, we expect the M&A markets for adhesives and sealants firms to remain competitive, with relatively high transaction multiples and strategic buyers relying on M&A to strengthen their competitive position or provide access to new markets. Private equity buyers will continue to build up existing adhesive and sealant platforms and look for new platforms in what remains a very fragmented market.

Smaller bolt-on or carve-out transactions are likely to be the norm, although we wouldn’t rule out the possibility for larger, more transformational deals. We have seen such transactions occurring in adjacent industries like coatings, as exemplified by Sherwin-Williams’ bid to acquire Valspar. While such deals can be more risky, recent large-scale transactions in the chemical industry may have put the corporate boards of the major adhesive and sealant manufacturers on alert and forced them to at least consider “going big” as a quick way to move up to (or maintain) the leading spot in the industry.

We also sense that some buyers are beginning to think that we are closer to the end of the business cycle than the beginning. With the Federal Reserve beginning to tighten short-term interest rates and the prospect of a highly unusual election this fall, the uncertainty level is rising. Couple that with an economic backdrop that is still favorable (at the moment) for M&A, and we may even see an acceleration in activity in the remainder of the year.

For more information, visit www.gracematthews.com.

Any views or opinions expressed in this article are those of the author and do not represent those of ASI, its staff, Editorial Advisory Board or BNP Media.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!