Strategic Solutions

Market Dynamics for North American Sealants

Through 2019, the building and construction market was a sealants volume leader, followed by assembly operations and transportation.

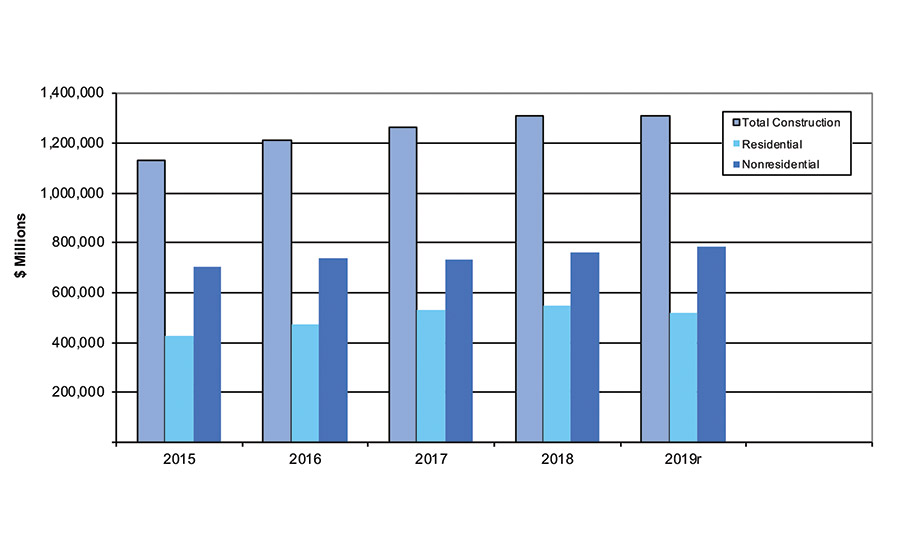

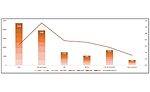

Figure 1. U.S. construction spending, 2015-2019.

(Source: U.S. Census Bureau.)

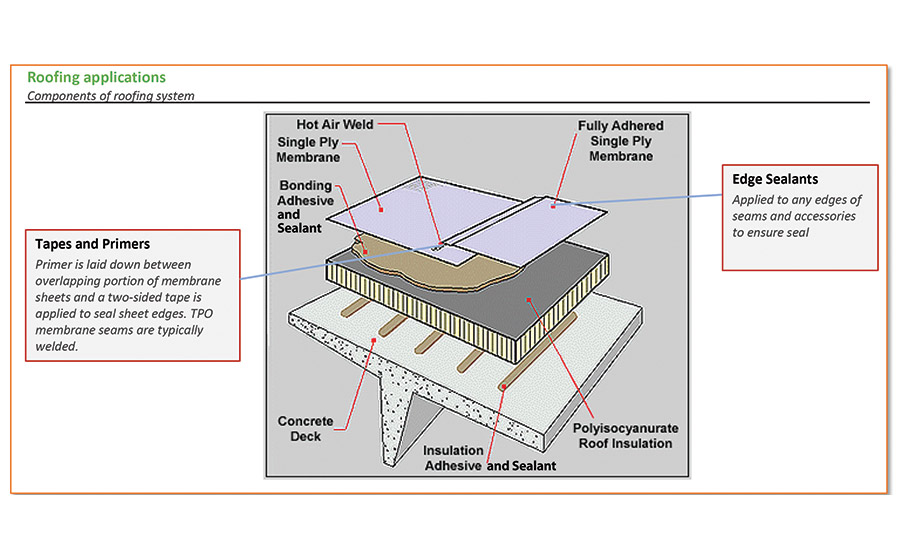

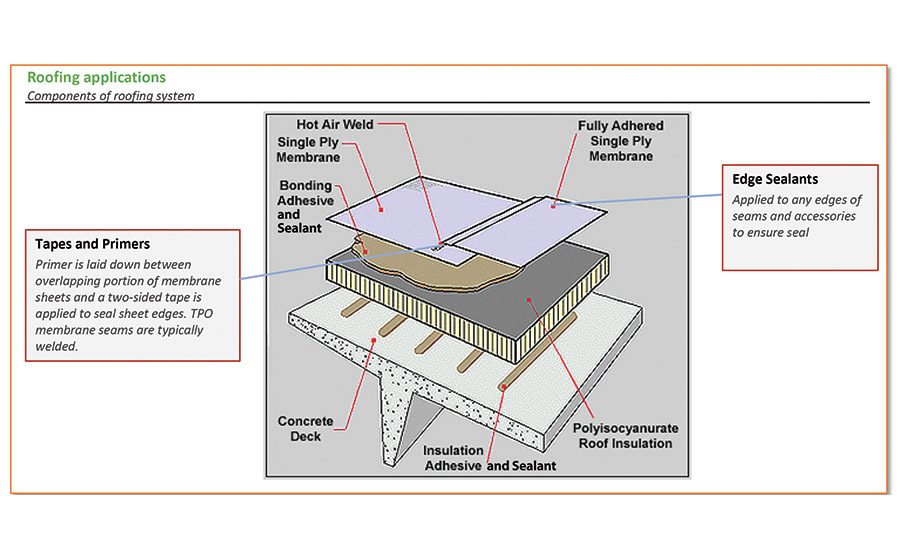

Figure 2. U.S. construction spending, 2015-2019.

(Source: The ChemQuest Group.)

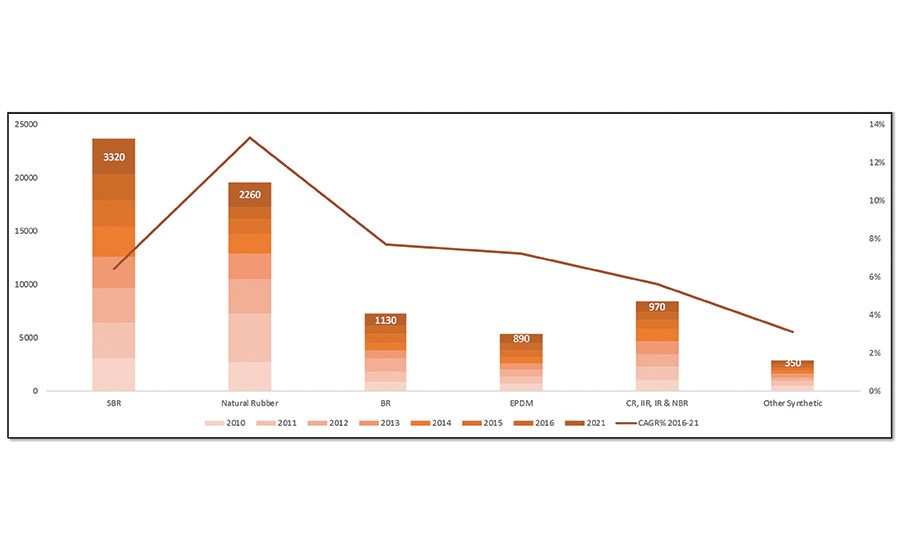

Figure 3. U.S. rubber demand by type, 2010-2016, 2021f ($ millions). Demand for butyl sealants is highly dependent on tire production.

(Source: Freedonia, U.S. Census Bureau.)

The wide use of dissimilar substrate materials driving the selection of sealants was reported in The Adhesive and Sealant Council’s “2017-2020 North American Market Report for Adhesives and Sealants with a Global Overview.” Report preparer ChemQuest cited the annual global forecast for sealants in 2020 as 2.8 billion pounds valued at $7.5 billion.

Through 2019, the building and construction market was a sealants volume leader, followed by assembly operations and transportation. Sustainability has led volume growth in the automotive, aerospace, and building construction industries, driven by environmental standards shifting use from solventborne to waterborne adhesives (barring various critical performance end uses that still reportedly require the use of certain solventborne sealants).

In lightweighting applications, sealants have successfully displaced welding as a joining method, preventing galvanic corrosion by shielding dissimilar metals from each other (e.g., in substrates and mechanical fasteners). Galvanic corrosion is not merely cosmetic; it can weaken sub-structural integrity.

Building and Construction

When building a new parking garage, joints between double-tee flanges, inverted T-beams, and ends of tees require a sealant. Sealant requirements for pre-topped systems are strictly adhered to because flange connections between tee deck elements are the most challenging of all parking structure jointing requirements. Good practice calls for recessing the sealant in the joint slightly below the parking deck surface to avoid direct vehicular contact.

According to multiple sources (PCI, ACI, NPA, joint sealant manufacturers, and other industry experts),1 the typical service life of joint sealants in a parking structure is 7-10 years, depending on design, exposure, and the owner’s joint maintenance program.

Two-component (2K) polyurethane sealants are preferred to seal precast concrete parking structures joints. Reportedly, silicone sealants have a higher resistance to UV-related deterioration, offering potential performance enhancements over polyurethane in direct and intense sun exposure. Silicone sealants have limited use, however, due to their higher cost and unsuitability to traffic exposure. To combat freeze-and-thaw cycles and chloride exposure, a field-applied silane sealer (sometimes followed by a traffic deck coating) may further enhance precast deck element durability while decreasing water absorption of field-placed concrete toppings and pour strips.

U.S. demand for roofing adhesives and sealants is also primarily driven by non-residential construction spending (spending through 2019 is shown in Figure 1). For example, edge sealants are commonly applied to roof seams and accessories to ensure a proper seal (see Figure 2).

Butyl sealants have excellent adhesion to porous and non-porous materials, as well as good durability. High-quality, plastic, 1K polybutylene-based sealants offer excellent adhesion to most building materials, with suitable resistance in outdoor exposure to UV, humidity, and temperature conditions. As building sealants, they are suited for low-expansion joints. The major use for heat-applied butyl sealants is in the manufacture of insulating glass windows (IGs). Butyl sealants are widely used in construction, mainly in lower-performance applications such as solventborne caulks and rope caulks. Prolonged low energy costs will slow window replacement and IG sealant growth.

Transportation Sealants

Butyl sealants, which are primarily used in recreational vehicles and manufactured housing, are highly dependent on overall rubber demand (see Figure 3). Butyl sealants are suitable for sealing applications such as: cracks in walls; around windows, windowsills, and doorframes; and gutters and drainpipes. In recent years, however, butyl sealants have lost share to 1K moisture-cure sealant products—either polyurethane or silane-modified polymer (SMP)—due to lightweighting, as well as modular and sealed construction of automotive components such as doors.

Sealants are used throughout vehicles to seal out water and air, and (most importantly) to reduce noise, vibration, and harshness (NVH). NVH standards have driven sealant growth as thinner materials and composites displace traditional materials. In most applications, sealants are 100% solids, with many reactive technologies providing both light adhesive and sealant performance.

Foaming sealants are gaining popularity due to lightweighting. Growing concerns over vehicle fires are driving technology toward fire-retardant sealants, mostly in passenger cage and underhood applications.

In aircraft, 2K polysulfide and polyether systems are widely used with application-dependent curing times that range from 8-180 hrs. Polysulfide sealants are used for applications such as fuel tanks and corrosion inhibitors. Long curing times for wing laminates (180 hrs) allow for positioning and some movement during construction and riveting. Fast repair sealants used for field repairs or leaks cure in approximately 8 hrs. Typical curing times for all other applications (including the windows, body, interior cabin, and fuel tanks) extend between 16-24 hours.

Whether intended for use on a large commercial aircraft or business jet, sealants must meet third-party validated requirements of the customer’s specifications. A third-party testing facility’s validation finding are followed by further validation testing in the customer’s laboratory.

Sealant formulations with lower specific gravity to achieve weight savings (e.g., 200+ lbs/plane) while also managing NVH concerns associated with new lighter/thinner substrates are in demand. In fact, adhesives and sealants are increasingly used in underhood applications as more plastic/composite components are incorporated into passenger vehicles to accommodate popular powertrain designs.

Sealants end users, producers, and distributors are encouraged to assist with updating, augmenting, and validating the ASC North American Market Report’s sealants quantitative and qualitative data for 2019-2022. Contact info@chemquest.com for participant details.

Reference

- Precast/Prestressed Concrete Institute (PCI), American Concrete Institute (ACI), and the National Parking Association (NPA), Parking Structures Committee Fast Team, “Joints in Precast Parking Structures,” PCI Journal, September-October 2007, www.pci.org.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!