Strategic Solutions

Patenting Considerations for Composition Inventions in the Adhesives and Sealants Industry

Incorporating compositions into process or assembly/device claims, although restrictive, can afford some protection. But is it enough?

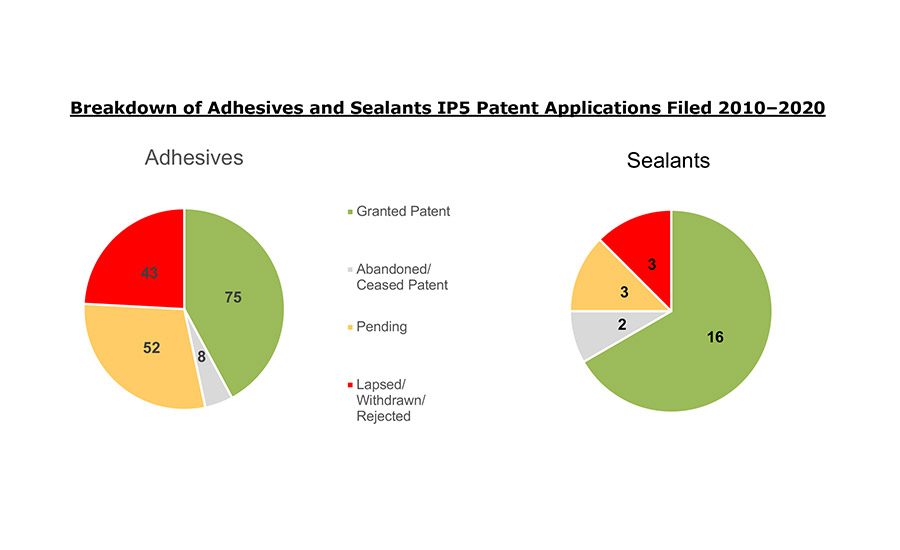

Figure 1. Breakdown of adhesives and sealants IP5 patent applications filed 2010-2020.

(Source: Patent Search and Analysis conducted by The ChemQuest Group using patsnap.com patent search platform.)

The global adhesives and sealants market grew from approximately $45 billion in 2010 to around $63 billion last year, according to The Adhesive and Sealant Council’s recently released “2020-2023 North American Market Report for Adhesives and Sealants, with a Global Overview.” During this period, over 200 patent applications (simple family groups) in the technical fields of adhesives and sealants were filed across the five major IP jurisdictions (US, EU, CN, JP, KR).

Interestingly, composition of matter (or chemical composition) claims constituted approximately 50% of the granted patents and at least 65% of the inactive (i.e., lapsed, withdrawn, or rejected) patent applications, the balance being process and assembly/device patents. A closer analysis of the granted process patents, especially in the field of adhesives, showed 65% of these to be fundamentally compositions claimed as methods or processes.

Composition Claims

The difficulty in securing composition claims is indicative of the challenge of inventing in a mature, crowded compositional space. Incorporating compositions into process or assembly/device claims, although restrictive, can afford some protection. But is it enough?

The answer to that question depends on the benefit of the patent to the assignee (i.e., the adhesive or sealant manufacturer). Does the manufacturer intend to:

- Commercialize or license the patented technology to generate a revenue stream

- Build an extensive patent portfolio to impress customers, shareholders, and competitors as a technology leader in the field

- Utilize patents as a reward/retention tool for its product developers and scientists

The purpose of patenting is usually some combination of the three to varying degrees based on company size, finances, and business model. However, if the predominant purpose of securing patent protection is the first point, then an assessment of the following factors can aid in deciding whether to seek patent protection or maintain the composition as a trade secret.

Novelty of Chemistry

Is the invention a new molecule (i.e., new chemistry) or a new combination of existing chemistries? New molecules offer opportunities for broad patent claims, and thus a stronger patent.

Detectability of Invention

Can the invention be easily detected in the final commercial article? If so, infringing the patent is more difficult (i.e., the patent is easier to enforce).

Enforceability of Invention Claims

This is impacted by detectability of the invention and patent jurisdiction. If the prevailing laws of a geographic region of commercial interest do not adequately support prosecution of patent infringement, filing a patent may invite copycat competitive products.

Ease of Workaround

How easily can a competitor use the teachings of the patent to develop an alternative solution that is outside the patent claims? Generally, the narrower or more restricted the claims, the easier they are to work around. As a result, if a composition is highly nuanced or if it is combined with process restrictions, the protection afforded by the patent is diminished and, in some cases, may even be detrimental competitively.

Freedom to Practice Trade Secret

How likely is a competitor to file a patent on the invention in jurisdiction(s) of interest in the event the invention is maintained as a trade secret, thereby potentially preventing you from manufacturing, selling, or using your own invention?

The decision to file ultimately depends on the manufacturer’s business goals and the competitive environment. However, an objective patent risk-benefit analysis can not only align IP strategy and cost with business development needs but also serve as a critical component of multi-generation product development and sales cycle planning based on availability and need for IP protection, as well as how quickly and easily the innovation can be copied or substituted.

Gaining Perspective

Another critical consideration for an innovator to develop competitive differentiated solutions is the need for definitive unbiased answers to questions such as:

- What value is the market willing to pay to use the new technology?

- What are the unmet market needs?

- How will my adhesives/sealant product perform when it leaves my laboratory?

A manufacturer developing technology solely within its own laboratory does so wearing blinders of ingrained norms, assumptions, and problem-solving approaches. Consider engaging a credible external partner to remove these blinders and augment internal resources with:

- A broader knowledge of unmet user needs across the specialty chemicals value chain

- A clearer vision of potential applications to allow for proper screening and prioritization of market opportunities

- An enhanced capability to redesign, synthesize, formulate, apply, and cure adhesives and sealants, with third-party validation of test data benchmarked against customer requirements

- Access to a real-world manufacturing and material testing facility for pilot runs and final testing of your products prior to implementation on your customer’s production line

Utilizing the right market knowledge, the right IP strategy, and the right execution partner can accelerate new product speed to market, increase competitive edge and thereby market leadership, and sustain business growth.

For more information, call (513) 469-7555, ext. 226; email info@chemquest.com; or visit www.chemquest.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!