Enabling High-Tech Innovation with Electronic Adhesives

Electronic adhesives are a vital part of electronic components, and are used in the manufacturing and assembly of a range of electronics products. Demand for electronic adhesives is constantly increasing, mainly due to the development and innovations in electronics products, along with the high penetration of smartphone devices.

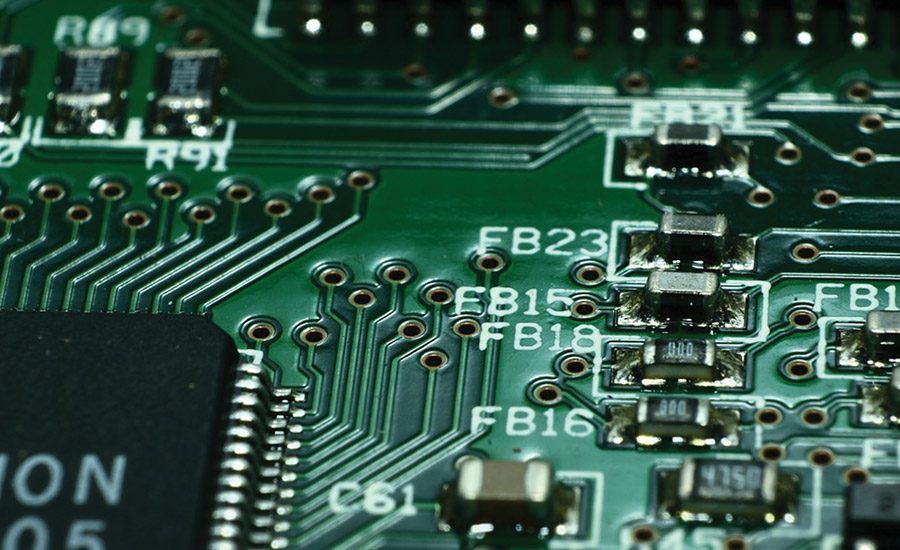

With technological innovations in terms of thermal and conductive properties, electronic adhesives have successfully replaced traditional soldering systems. Used for more than just a strong bond, electronic adhesives have three major types: electrically conductive, thermal conductive, and UV curing. These adhesives find many applications in surface-mount devices (SMDs), conformal coatings, potting and encapsulation, and others.

Breakthroughs in Electronic Adhesives

Electronics manufacturers are compelled to develop smarter designs and advanced products to stand out in today’s competitive markets, as consumers demand thinner and more compact devices. From CDs, pen drives, and smartphones to refrigerators and other home appliances, a vast range of products is available with different functionality and designs. Over the last few years, consumers have become brand-conscious due to increased awareness levels and enhanced lifestyles. They expect their products to be less costly, highly durable, and—at the same time—aesthetically pleasing.

Such novel trends and innovations in consumer products help fuel the demand for electronic adhesives, as they play an extremely important role in the manufacturing of these products by offering benefits such as shorter production time, reduced weight and costs of products, enhanced product performance, durable and longer-lasting bonds, and increased product shelf life. Following are some of the recent innovations in the field of electronic adhesives.

Figure 1. U.S. electronic adhesives market revenue by product, 2012-2022 ($ million). Image source: www.grandviewresearch.com

Nanomaterials for Electrically Conductive Adhesives

Electrically conductive electronic adhesives (ECAs) make a great substitute for conventional tin-lead solders, as they have better efficiency and are cost-effective. This type of electronic adhesive finds applications mainly in the building and construction, automotive, and medical industries. This is reportedly the key factor driving the global demand for electronic adhesives. In the past, these adhesives accounted for 448.5 kilotons of the overall demand and may witness a steady rise in demand over the next few years. This increase can be attributed to rapid advancements in technology and end-use applications.

Engage Biometrics, Celestica, Juniper and Microbonds—in collaboration with the University of Waterloo—are developing nanomaterials for electrically conductive electronic adhesives. Refined Manufacturing Acceleration Process (ReMAP) is a federally funded Canadian accelerator for advanced electronics manufacturing. The group is developing ECA materials that can support higher density interconnects, electronics miniaturization, and larger process windows.

The team used nanomaterials to enable connections, such as bendable and flexible electronic assemblies, where the conventional alloy solder is not viable. Nanomaterials are cheaper than other materials, yet they offer the longest shelf life and highest strength.

An Alternative to Potting Process

Thermally conductive electronic adhesives with epoxy and silicone generated a revenue share of $1 billion in 2014. At present, these adhesives are in great demand from a variety of applications, including chip-scale packaging and power semiconductors, due to their excellent heat conducting properties. They are likely to witness more demand in the years to come due to rapid innovations in product and technology. For example, Henkel Adhesive Technologies added a new thermally conductive solution to its Technomelt range of hot-melt electronic adhesives. The new product reportedly has the ability to transfer heat through the encapsulating layer, offering dual-function performance in a single solution.

Another example can be found in new heat-dissipating, low-modulus electronic adhesive sheets by Toyochem Specialty Chemical Sdn. Bhd., called Lioelm FTS. The new sheets of electronic adhesives are reportedly thermally conductive, as well as soft and flexible, which makes them an option for power device heat sinking, especially in the automotive sector. Lioelm FTS is a thermal material that maintains low elastic modulus. Moreover, due to its special rheology and soft consistency, it conforms to any rough surface, thereby developing a high-strength interface between the package and the heatsink, according to the company. It uses a unique polymer with excellent conductive fillers, which further allows the interface material to dissipate significant levels of heat for the most demanding high-power electronics, particularly for next-gen electric automobiles.

Figure 2. U.S. electronic adhesives market revenue by product, 2012-2022 ($ million). Image source: www.grandviewresearch.com

UV-Cured Epoxies

UV-curing electronic adhesives or light-curing adhesives find major applications in the production of glass furniture, glassware, and acrylic glass, due to various properties such as high reliability and transparency and excellent stability in harsh environments like humidity. However, they can also be used in medical technology and the optical industry. These adhesives are projected to expand at a healthy growth rate of 12% from 2015 to 2022, mainly due to constant product improvements and increasing product penetration across the global medical industry.

In the recent past, Engineered Material System (EMS) introduced 535-11M-12 UV-cured epoxy adhesive that reportedly eliminates warping in electronics assemblies. The new adhesive is designed especially for usage in screen printing processes; however, it can also be used for lens bonding and chip encapsulation for smart cards. It also forms part of its manufacturing company’s semiconductor, circuit assembly, disk drive, printer head, camera module, and photonics assembly adhesives.

Asia-Pacific: An Emerging Market

Asia-Pacific is the largest regional consumer for electronic adhesives, due to the presence of large-scale production of conformal coatings and SMDs. This trend is expected to continue in the next few years as a result of rapidly expanding electronics, automotive, and healthcare sectors in China, India, South Korea, Taiwan, and other developing countries. India and China, however, are anticipated to be the dominant consumers of electronic adhesives in terms of production.

Companies from different sectors are focusing on shifting their production units to Asia-Pacific, due to the availability of cheap labor, increasing number electronic adhesives patents, drastically improving economic growth rate, and growing manufacturing industries. This factor is also creating tremendous growth opportunities and new application areas for electronic adhesives in the region. Moreover, the availability of raw materials and technological expertise, along with increasing urbanization and, thus connectivity, are also boosting the regional demand for electronic adhesives. Quick adoption of advanced technologies in the production of vehicle safety solutions and infotainment systems is fueling the demand for printed circuit boards in the region. This, in turn, is expected to drive the demand for the electronic adhesives in the forthcoming years.

In addition, ongoing efforts to attract more companies to invest in the region, such as Chinaplas, an Asian trade show dedicated to rubber and plastics industries, is also boosting the region’s development. This international trade fair is reportedly the second-largest trade show in the world.

The Future for Electronic Adhesives

The global electronic adhesives market is anticipated to show rapid development, registering a healthy growth rate of around 10.6% from 2015 to 2022. The global market was valued at $3.28 billion in 2014, and is expected to reach a valuation of around $7.8 billion by 2022.

Constant technological and product innovation is one of the major factors behind the rapid growth of the electronic adhesives market. A trend of miniaturization of electronic devices due to advances in consumer electronics such as smartphones and other similar devices and home appliances is another prominent factor driving the market. In addition, innovative semiconductor technologies in consumer and industrial applications would also have a positive impact on the demands for electronic adhesives.

Overcoming Challenges

Rising financial support from various government and private firms to encourage innovations in electronic adhesives would propel the global demand for electronic adhesives in the years to come. For example, a team of experts at the faculty of engineering of the University of Porto has introduced a new polymer coating method for flexible electronics. The new method leads to high-performance conductive materials for flexible electronic products.

This method involves metallization of a polymer surface by masking it with another polymer with a strong affinity to the metal to deposit. The second polymer acts as a double-sided tape adhesive; one side of it is anchored to the base material and the other offers the potential to adhere to the metal sheet or film. According to the developers, this method, prior to metallization, can be applied to the plating of other polymer substrates and metals, provided that the selected solvent dissolves PVP and swells polymer without degrading it.

Industry experts are increasingly focusing on overcoming the challenges of modern-day electronic designs through innovative ways for assemblies and packaging systems. Moreover, growing investments in research and development for microelectronic devices, like flexible sensors, by adhesives and sealants industry giants will also create new applications and growth opportunities for electronic adhesives.

Visit www.grandviewresearch.com for additional information

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!